Nvidia Stock Falls Amid China Investigation: Is There Reason to Worry?

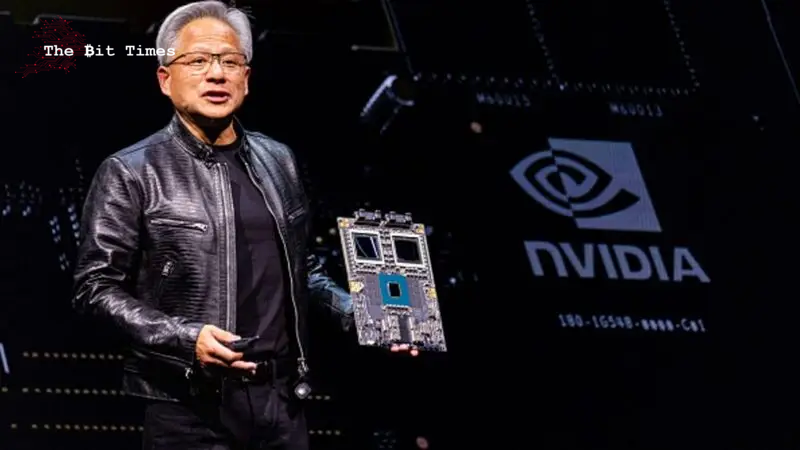

In a rather surprising blow to the stock, Nvidia (NVDA) has fallen due to the ongoing China investigation, with traders starting to worry. Indeed, the semiconductor company has been the subject of an antitrust probe with ongoing concerns regarding how the AI-related stock could be affected by the present political and economic landscape.

On its own merits, there is no denying the potential for the chipmaker entering 2025. Specifically, the stock was among the favorites to become the first company to reach a $4 trillion market cap. Yet, the investigation was met with a stark price drop, as Wall Street appears concerned.

Also Read: Nvidia (NVDA) Set for Record-Breaking 2025 Amid ‘Staggering’ Demand

Chian Announces Nvidia Investigation as Stock Falls Over 3%

There is little argument against the reality that the AI revolution has completely changed the technology sector. With the arrival of OpenAI’s ChatGPT and its meteoric rise, the growing industry has been the most popular on Wall Street. That had been critical to the success of one of the year’s biggest risers.

Nvidia is up more than 187% over the last twelve months. A massive reason why is that it is currently the leader in data center chips needed for critical intelligence development. Although competitors like AMD have emerged, they have been unable to wrestle enough market share from NVDA to truly be competitive.

Also Read: Can Nvidia Hit $200 Before 2025 Arrives?

That could be set to change. Indeed, Nvidia has seen its stock fall noticeably amid news that China is launching an antitrust investigation. Specifically, the tech stock dropped as much as 3% Monday as traders found some reason to worry.

China has raised concerns about “implications for foreign businesses operating” in the United States, one report said. Moreover, the State Administration for Market Regulation (SAMR) has suspected a violation of anti-monopoly laws. However, they have yet to issue any specific charges or allegations.

With Trump’s tariff plan bound to complicate things even more, there is ongoing uncertainty regarding economic relations between Chinese and American companies. Unfortunately, Nvidia is seemingly caught in the middle of it. Its success in 2025 hinges on its ability to maneuver through these allegations and continue its upward trajectory.

Comments

Post a Comment