PayPal applies for NFT marketplace patent for on- or off-chain asset trading

PayPal made major progress toward creating its own blockchain ecosystem by filing a patent application for a nonfungible token (NFT) purchase and transfer system. The application, filed in March and published Sept. 21, describes a means of carrying out transactions with NFTs, both on- and off-chain.

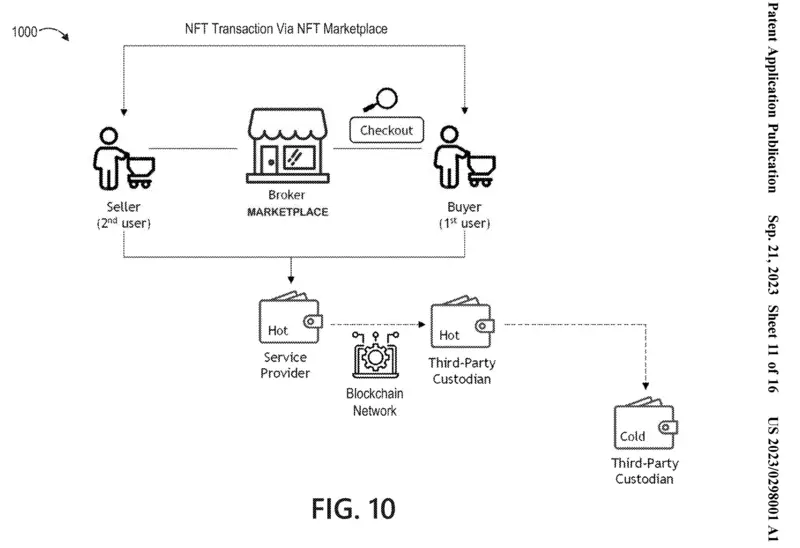

The patent application, which is still pending, describes a system where users can buy and sell NFTs through a third-party service provider. That provider is not specified, though Ethereum is mentioned in the text.

Related: PayPal enables US users to sell cryptocurrency via MetaMask wallet

PayPal envisioned using the full potential of NFTs for tokenization, going far beyond the exchange of electronic collectibles:

“The NFT in this example may represent any unique piece of digital data that can be tracked using a decentralized blockchain ledger. […] Examples of such assets include [...] digital images and videos, music, collectibles, and other digital art along with deeds to personal property, event tickets, legal documents and other real-world items.”

The system could be customized in a variety of ways. For example, it could accommodate fractionalized purchases through the distribution of governance tokens, which then could be traded themselves. In addition, a decentralized autonomous organization “associated with the service provider may be used to promote NFT liquidity through a dedicated platform.” NFTs could also earn income from royalties.

Processing by the service provider could include compliance and risk management. Users could have their own digital wallets but would not be required to. A third-party broker could provide a variety of storage and checkout services as an alternative. Off-chain transactions could be handled within an “omnibus wallet” associated with the service provider and containing both the buyer and seller’s wallets:

“Therefore, no transfer is registered on the blockchain and there is no need to broadcast the transaction to the blockchain network or pay the gas fees associated with such an on-chain transaction.”

Any currency could be used in the system, according to the application. In August, PayPal introduced its own stablecoin, PayPal USD (PYUSD), built on Ethereum.

It’s day one as @PayPal's President and CEO. I'm fired up to join this team on a powerful mission and with a remarkable history of revolutionizing how millions around the world take control of their financial lives. PayPal team, let’s go change the world! pic.twitter.com/PIZuY8iKn2

— Alex Chriss (@acce) September 27, 2023

Magazine: Tokenizing music royalties as NFTs could help the next Taylor Swift

Comments

Post a Comment