1 USDT ≠ 1 USDT: Unveiling Exchange Rate Challenges and Risks in the Realm of 'Black-Market U'

Author: Bitrace

Source: https://mp.weixin.qq.com/s/WiY7Ts8lylFWLcYk2b6_QQ

Stablecoins are one of the crucial infrastructures in our industry, achieving value stability by pegging to the fiat currency of a specific country. Ordinary users use them as important means of storage and payment, while web3 institutions utilize them as operational tools. The diverse demand has created a flourishing stablecoin market. However, they are also exploited by illicit activities such as network fraud, online gambling, and money laundering. When ordinary investors or web3 enterprises inadvertently receive stablecoins associated with illegal activities, they may face enforcement risks.

Bitrace’s research found that in the process of laundering risk crypto funds, criminals widely accept stablecoins of different risk categories that deviate substantially from the market exchange rate. Taking Tether (USDT, hereinafter referred to as U), the stablecoin with the highest market share, as an example:

Black-market U Risk Source

“Reverse Freeze” is a phrase popular among the cryptocurrency acceptance community, meaning that if an exchange address receives USDT related to a case, the exchange account may be frozen by law enforcement agencies. This type of enforcement freeze is not limited to centralized cryptocurrency trading platforms. On decentralized blockchain addresses, the issuer of USDT, Tether, can legally assist law enforcement agencies around the world in sanctioning certain involved addresses. This involves selectively “blacklisting” a specific address to restrict its USDT operation permissions, achieving a de facto freezing of funds.

A few days ago, the cryptocurrency trading platform OKX announced that it had collaborated with Tether to complete the targeted freezing of assets totaling 225 million USDT for multiple on-chain addresses. These funds were allegedly linked to scams like pig-butchering and human trafficking.

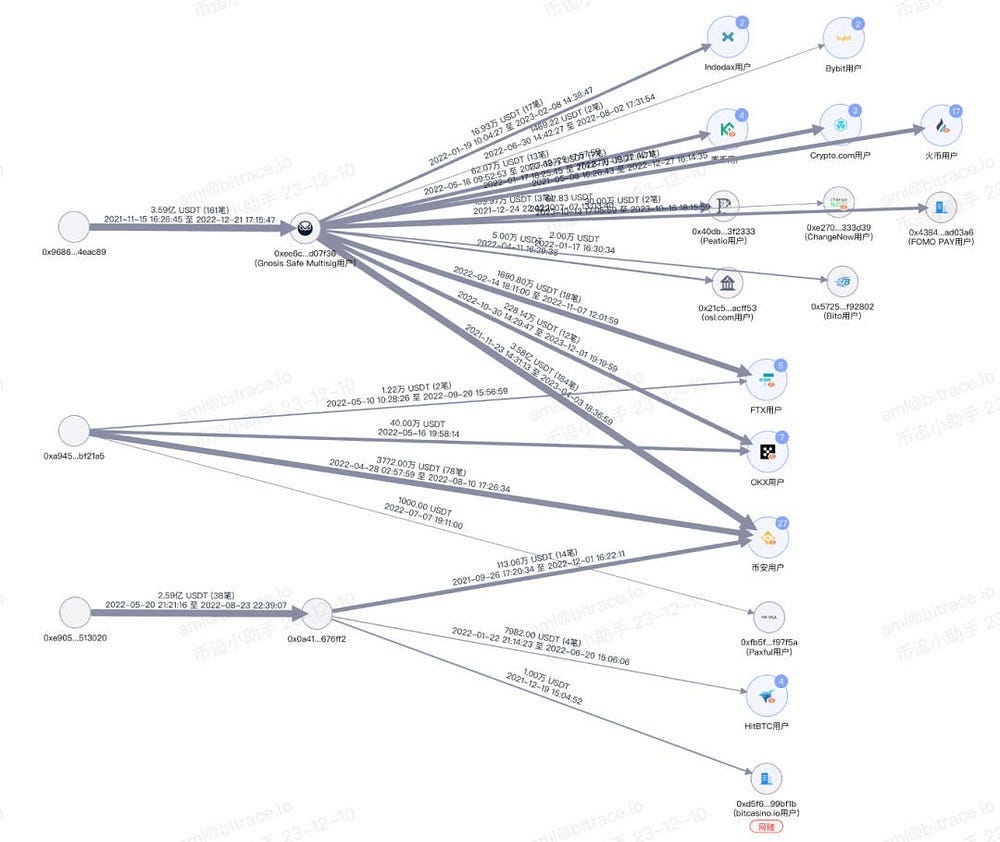

Bitrace audited some disclosed addresses. In terms of fund sources, we found that this criminal group not only used OKX for fund turnover but also used well-known cryptocurrency trading platforms like FTX and Binance, with a massive fund scale.

Subsequent fund tracking shows that more centralized trading platforms, payment platforms, and even online gambling platforms have been involved, becoming unwitting money laundering places for criminals.

Even if OKX did not cooperate with law enforcement, these web3 enterprises may have assisted law enforcement in sanctioning these addresses for compliance purposes. In other words, whether it is fiat or compliant stablecoins, for criminal groups, they are not “safe” tools for value storage. They often need to quickly launder the involved assets to eliminate risks or cash out in a timely manner.

We believe that this demand for laundering risk avoidance is a significant reason for the substantial deviation of illegal transactions from the exchange rates.

Upward U Scenario

“Score Running” is a term used by criminals to refer to money laundering activities. The purpose of such activities is to transfer payments from high-risk users to low-risk users’ accounts, thereby evading the risk control measures of payment institutions. Traditional score running involves transferring, splitting, and cashing out funds from personal accounts such as banks, WeChat, and Alipay. In recent years, cryptocurrencies — especially stablecoins — have become new tools for score running.

Typically, score running platforms recruit various individuals to register accounts on cryptocurrency trading platforms and link them to their bank cards. They allow score running personnel to take orders on the platform, buy a specific amount of USDT at market prices on the OTC section of the exchange, and sell it back to the score running platform at a higher price. The difference is the income for the score running personnel. In practice, the funds recovered by the score running platform in USDT are the involved funds. Through this method, the score running platform can launder funds without dealing with fiat currency directly.

The profit of the score running platform comes from upstream distribution, including commissions for different risk categories of involved funds. For example, gambling funds are considered lower-risk, so the commission is lower, while fraudulent funds are often seen as higher risk, resulting in higher commissions. Some score running platforms even refuse to accept high-risk funds.

The difference in commissions is directly reflected in the exchange rate of USDT transactions. Higher-risk funds mean higher price markups. In practical investigations, it is not uncommon to encounter illegal USDT transactions with prices exceeding 8 RMB or even 10 RMB.

Downward U Scenario:

So far, most low-priced USDT transactions under the reasons of “Black-market U carry bricks arbitrage” and “black/white fund collection U” are fraudulent activities. Bitrace previously introduced events such as “Black-market U pig-butchering scam” and offline cash transaction robberies in past articles. However, there are still many scenarios of USDT transactions at rates lower than the market exchange rate, such as illegal proxy payment platforms.

Some proxy payment platforms accept USDT deposits and use fiat funds to help users make payments on other platforms, including topping up on online gambling platforms, settling member funds for fund platforms, giving gifts on live broadcasting platforms, placing orders on e-commerce platforms, and even paying salaries to employees.

Proxy payment platforms do not distinguish the source of users’ USDT or have a comprehensive KYC mechanism, resulting in a large influx of high-risk funds. This is why the fee sources and destinations of illegal addresses in some cases are shown as associated with online gambling platforms on the blockchain. Using this almost anonymous transaction method for cashing out, practitioners in the black and gray industry do not need to register accounts on centralized compliant cryptocurrency trading platforms, significantly reducing the risk of “reverse freezing.”

Practical case investigations show that the USDT involved in such illegal proxy activities often deviates from the market exchange rate by 0.05 RMB to 0.3 RMB. The specific degree of deviation depends on the source of fiat funds for the proxy payment platform and the user’s fund scale.

Beware of USDT Money Laundering Risks

Bitrace conducted a fund audit for some addresses in the Tron network marked as having money laundering risks and with a fund scale exceeding 1 million USDT. The audit period was from September 2021 to March 2023, focusing on USDT inflows.

Data shows that from September 2021 to March 2023, addresses with money laundering risks in the Tron network received a total of over 64.25 billion USDT. The fund scale has not been affected by the bear market in the cryptocurrency secondary market, indicating that the participants in their business are not genuine investors.

Combining the above two risk scenarios, it indicates that cryptocurrencies, mainly stablecoins, are being maliciously exploited by money laundering gangs. In order to evade sanctions from centralized trading platforms and law enforcement agencies, criminals will confuse funds through the encrypted addresses of illicit entities or use over-the-counter transactions to block the fund Analysis chain, and the illegal USDT transactions with a significant deviation from the market exchange rate are typical characteristics.

In Conclusion

According to The Block’s report, the issuing company of USDT has issued a letter to the U.S. Senate Committee on Banking, Housing, and Urban Affairs and the U.S. House Committee on Financial Services, outlining its “commitment to security and close working relationship with law enforcement agencies.” It also announced the inclusion of the U.S. Secret Service and the “doing the same thing” Federal Bureau of Investigation into its platform.

This clearly demonstrates Tether’s compliance intentions in the stablecoin business category. For web3 enterprises serving a large number of ordinary C-end customers, optimizing anti-money laundering risk control strategies for risk cryptocurrencies on the platform, establishing law enforcement cooperation and compliance departments serving various national government departments, have become important matters that cannot be ignored.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish

Comments

Post a Comment